Retirement Gratuity Calculation Formula for Central Govt Employees 2025

🧮 Retirement Gratuity Calculation Formula for Central Govt Employees (2025)

Retirement gratuity is a lump sum amount paid by the Central Government to its employees as a token of appreciation for their long and dedicated service. This is governed by the Central Civil Services (Pension) Rules.

It is an important financial benefit that helps employees plan their post-retirement life. Understanding how gratuity is calculated, who is eligible, and what the latest rules are is essential for every government employee.

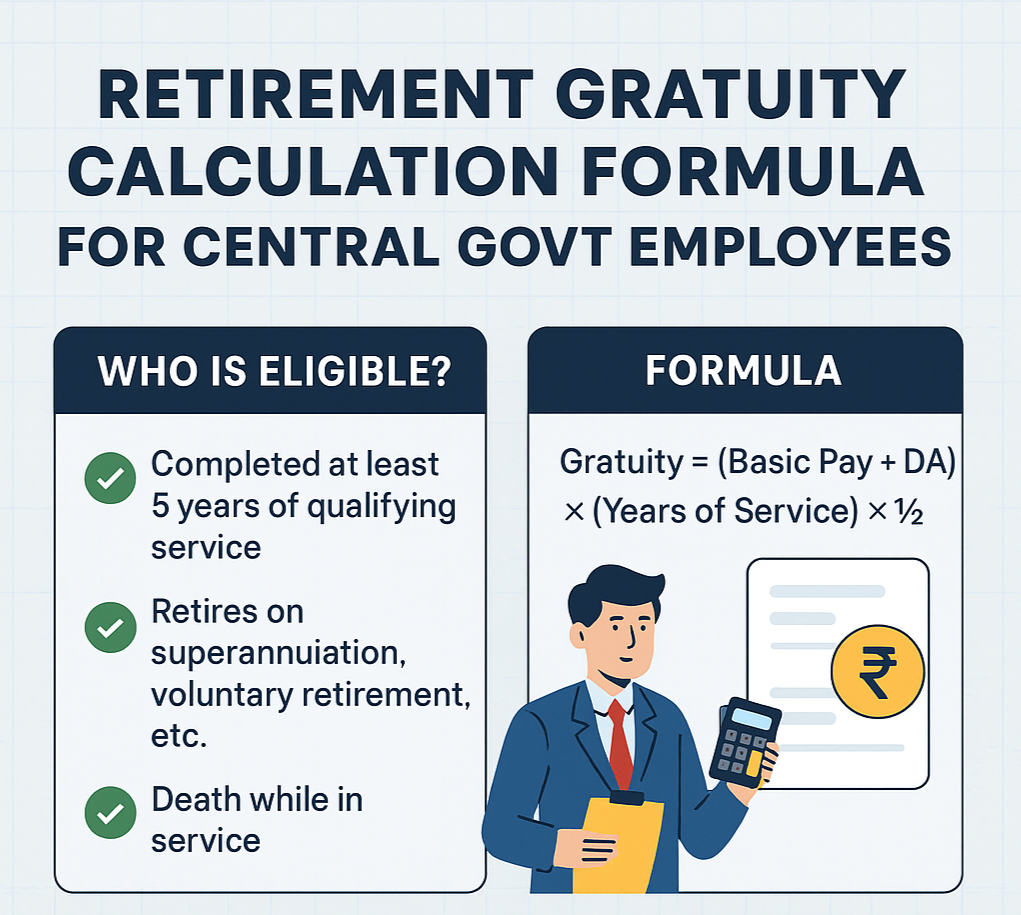

👔 Who is Eligible for Retirement Gratuity?

A Central Government employee becomes eligible for retirement gratuity when:

- They complete at least 5 years of qualifying service.

- They retire on superannuation, voluntary retirement, or are retired on medical grounds.

- In case of death while in service, gratuity is payable even if service is less than 5 years.

👉 Both permanent and temporary employees are covered under this benefit.

📌 Retirement Gratuity Calculation Formula

The retirement gratuity is calculated based on the last drawn basic pay + Dearness Allowance (DA) and the number of completed years of service.

🧮 Formula:

\text{Retirement Gratuity} = \text{(Basic Pay + DA) × 1/4 × No. of completed six-monthly periods of qualifying service}

✅ OR simplified as:

\text{Gratuity} = \text{(Basic Pay + DA) × (Years of Service) × ½}

Click Here Online Calculation

⏱️ Step-by-Step Calculation Example

Let’s understand this with a practical example:

- Basic Pay + DA: ₹80,000

- Length of Qualifying Service: 30 years

👉 First, convert service years into six-monthly periods:

- 30 years = 60 six-month periods

👉 Apply formula:

80,000 × ¼ × 60 = ₹12,00,000

✅ Final Retirement Gratuity = ₹12,00,000

📊 Maximum Gratuity Limit

As per the 7th Central Pay Commission, the maximum limit of retirement gratuity is ₹20 lakh (w.e.f. 01.01.2016).

The limit may be revised in future pay commissions or government notifications.

👉 If the calculated gratuity exceeds ₹20 lakh, the employee will receive only ₹20 lakh.

⚖️ Tax Exemption on Gratuity

Retirement gratuity received by Central Government employees is fully exempt from Income Tax under Section 10(10)(i) of the Income Tax Act, 1961.

✅ No tax is applicable on the gratuity amount, unlike private sector employees where certain limits apply.

📅 Gratuity Calculation for Less Than 6 Months

- If an employee has completed more than 3 months but less than 6 months, it is treated as half a year for gratuity purposes.

- If service is less than 3 months, it is ignored.

👉 For example, 25 years and 7 months of service will be counted as 26 years.

📝 Special Cases

-

Death while in service

- Gratuity is payable even if the employee has not completed 5 years of service.

- The amount depends on the length of service and cause of death.

-

Resignation before 5 years

- If an employee resigns before completing 5 years, no gratuity is payable (except in death cases).

-

Retirement on medical grounds

- Eligible gratuity is paid based on actual service.

📌 Quick Reference Table

| Particulars | Details |

|---|---|

| Minimum Service Required | 5 years (except death cases) |

| Calculation Formula | (Basic Pay + DA) × 1/4 × No. of six-monthly periods |

| Maximum Limit | ₹20 lakh |

| Tax Status | Fully Tax-Free |

| Rounding Rule | More than 3 months = ½ year; less than 3 months ignored |

🧭 Conclusion

Retirement gratuity is a significant post-retirement benefit for Central Government employees. By understanding the calculation formula, employees can plan their finances better and avoid confusion at the time of retirement.

The key takeaway is:

💡 Gratuity = (Last Pay + DA) × No. of half-years of service × ¼, subject to a maximum of ₹20 lakh and full tax exemption.

📝 Disclaimer

The information provided in this article is for general understanding. For exact calculations and eligibility, employees should refer to CCS (Pension) Rules or contact their respective department’s pension office.

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.png)

.png)